Senior Health Coverage Secrets Insurers Keep Quiet About

If you're navigating the maze of senior health coverage, understanding the secrets insurers keep quiet about can save you time and money, prompting you to browse options and see these opportunities that could significantly impact your healthcare decisions.

Understanding Senior Health Coverage

Senior health coverage is a complex landscape, often shrouded in confusion and fine print. At its core, it encompasses Medicare, Medicare Advantage plans, and supplemental insurance options. Each of these has its nuances and benefits, which can significantly affect your healthcare costs and coverage.

Medicare, the federal health insurance program for people aged 65 and older, is divided into several parts: Part A covers hospital insurance, Part B covers medical insurance, Part C (Medicare Advantage) offers an alternative way to receive your Medicare benefits, and Part D covers prescription drugs. Many seniors are unaware of the additional benefits that Medicare Advantage plans can offer, such as dental, vision, and hearing coverage, which are not typically covered under traditional Medicare1.

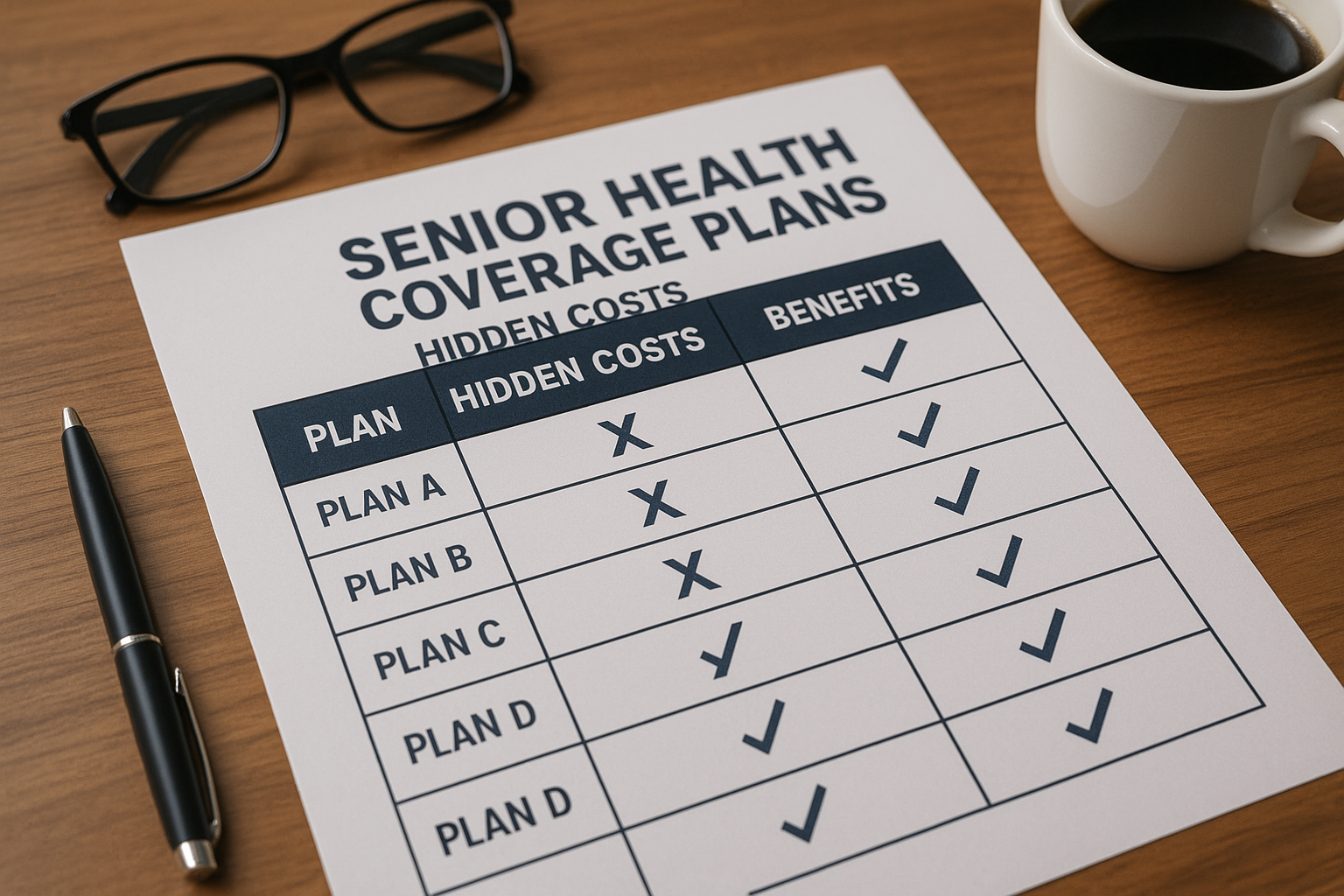

The Hidden Costs and Savings

One of the biggest secrets in senior health coverage is the variation in costs between different plans and providers. While Medicare Part A is generally premium-free for most seniors, Part B requires a monthly premium that can change based on your income. Additionally, Medicare Advantage plans may offer lower premiums but could include higher out-of-pocket costs for certain services2.

Supplemental insurance, or Medigap, is another area where seniors can find significant savings or unexpected costs. These plans can help cover out-of-pocket expenses not covered by Medicare, but premiums can vary widely depending on the provider and the level of coverage. For many seniors, comparing Medigap policies can reveal opportunities for substantial savings3.

The Importance of Prescription Drug Coverage

Prescription drug costs are another critical factor in senior health coverage. Medicare Part D provides prescription drug coverage, but the costs and coverage can vary significantly between plans. Some plans may offer lower premiums but higher copayments for specific medications. It's crucial to review your prescription needs annually and compare Part D plans to ensure you are getting the best coverage at the lowest cost4.

Maximizing Your Coverage Benefits

To make the most of your senior health coverage, it's vital to stay informed and proactive. Regularly reviewing your plan options during the Medicare Open Enrollment period can ensure you are not overpaying for coverage you don't need or missing out on benefits that could enhance your healthcare experience. Many resources are available to help you compare plans and understand your options, including the official Medicare website and independent insurance advisors.

Navigating senior health coverage can be daunting, but understanding the hidden secrets and opportunities can lead to better coverage and potential savings. By staying informed and exploring your options, you can tailor your health coverage to suit your needs and financial situation. Remember to browse options and visit websites that offer detailed plan comparisons and expert advice, ensuring you make the most informed decisions regarding your healthcare.