Access Hidden Medicare Advantage Options That Supercharge Savings

Accessing hidden Medicare Advantage options can unlock significant savings on your healthcare expenses, and by taking the time to browse options, you might discover plans that perfectly suit your needs while reducing costs.

Understanding Medicare Advantage Plans

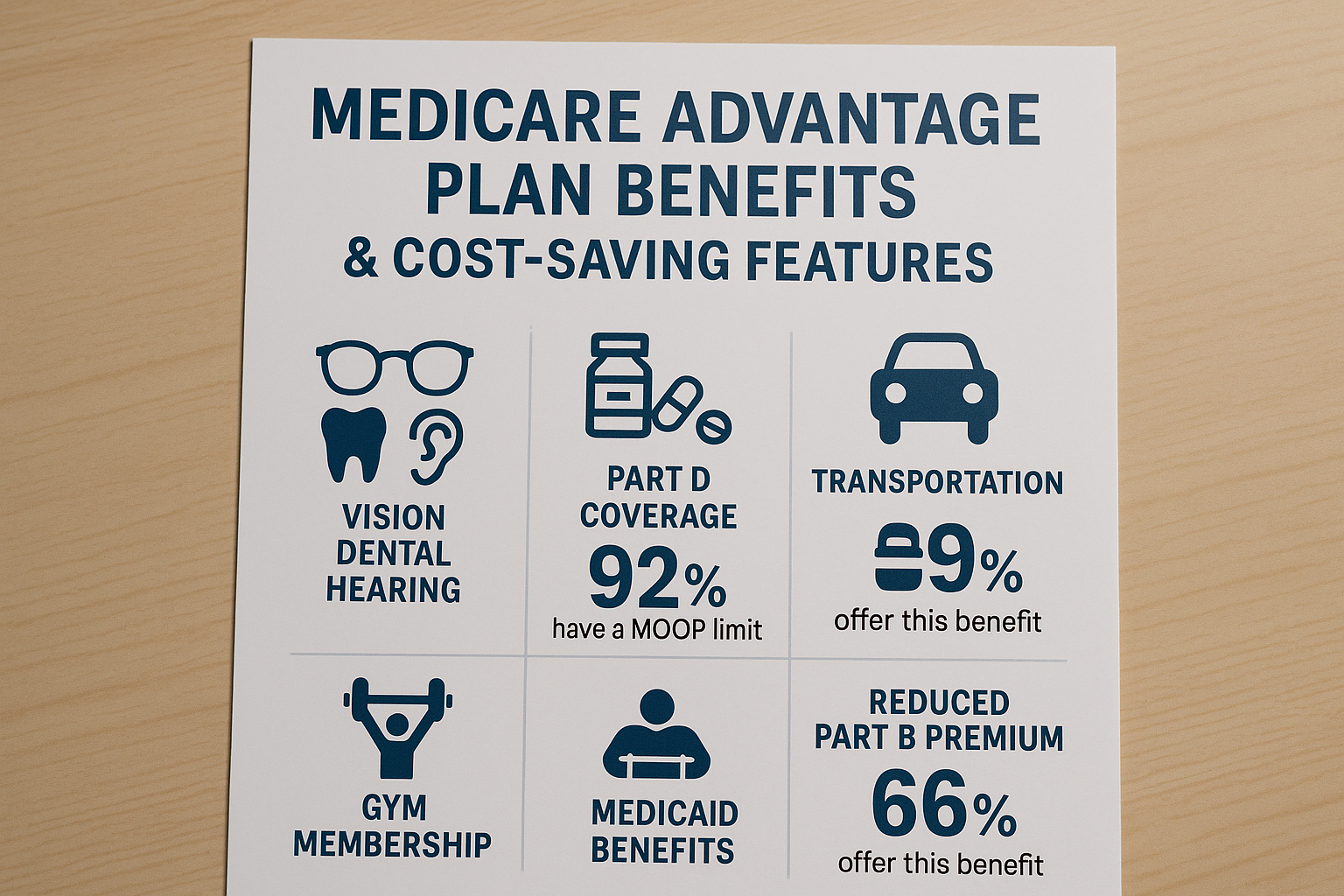

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare that offers additional benefits through private insurance companies approved by Medicare. These plans often include coverage for services not covered by Original Medicare, such as vision, dental, and hearing care, and may also offer prescription drug coverage. The key advantage is that these plans can provide more comprehensive coverage with potentially lower out-of-pocket costs, making them an attractive option for many seniors.

Types of Medicare Advantage Plans

There are several types of Medicare Advantage plans, each designed to meet different healthcare needs:

- Health Maintenance Organization (HMO) Plans: These plans require you to use a network of doctors and hospitals, except in emergencies. They often include prescription drug coverage.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility in choosing healthcare providers and do not require referrals for specialists. They also typically include prescription drug coverage.

- Private Fee-for-Service (PFFS) Plans: These plans allow you to see any Medicare-approved doctor or hospital that accepts the plan's payment terms.

- Special Needs Plans (SNPs): SNPs are tailored for individuals with specific diseases or characteristics and provide specialized care.

Maximizing Savings with Medicare Advantage

One of the most compelling reasons to consider a Medicare Advantage plan is the potential for savings. Unlike Original Medicare, these plans often have a cap on out-of-pocket expenses, which can protect you from exorbitant costs. Additionally, many Medicare Advantage plans offer low or zero premiums, making them a cost-effective choice for seniors on a fixed income1.

Exploring Additional Benefits

Medicare Advantage plans frequently offer additional benefits that can enhance your quality of life. These may include fitness programs, transportation services, and over-the-counter medication allowances. Some plans even offer wellness programs that focus on preventive care, helping you maintain your health and avoid costly medical interventions2.

How to Choose the Right Plan

Choosing the right Medicare Advantage plan requires careful consideration of your healthcare needs and financial situation. Start by evaluating the types of coverage you require and compare the costs and benefits of different plans. It's essential to review the network of providers and ensure your preferred doctors and hospitals are included. Additionally, some plans offer unique benefits that cater to specific health conditions, which can be particularly beneficial if you have ongoing health concerns3.

Finding Hidden Opportunities

To access the best Medicare Advantage options, consider using online tools and resources that allow you to compare plans based on your location and personal health needs. Many websites offer detailed comparisons and user reviews, providing insights into the experiences of other beneficiaries. By visiting these websites and exploring your options, you can uncover plans that offer exceptional value and meet your healthcare requirements.

In summary, Medicare Advantage plans present an opportunity to enhance your healthcare coverage while potentially reducing costs. By exploring the various plan types and benefits, you can find a solution that not only meets your medical needs but also fits your budget. Take the time to search options and visit websites to ensure you are making the most informed decision possible.