Senior Health Coverage Secrets Insurers Keep Quiet About

If you're navigating the maze of senior health coverage, understanding the secrets insurers keep quiet about can save you time and money, prompting you to browse options and see these opportunities that could significantly impact your healthcare decisions.

Understanding Senior Health Coverage

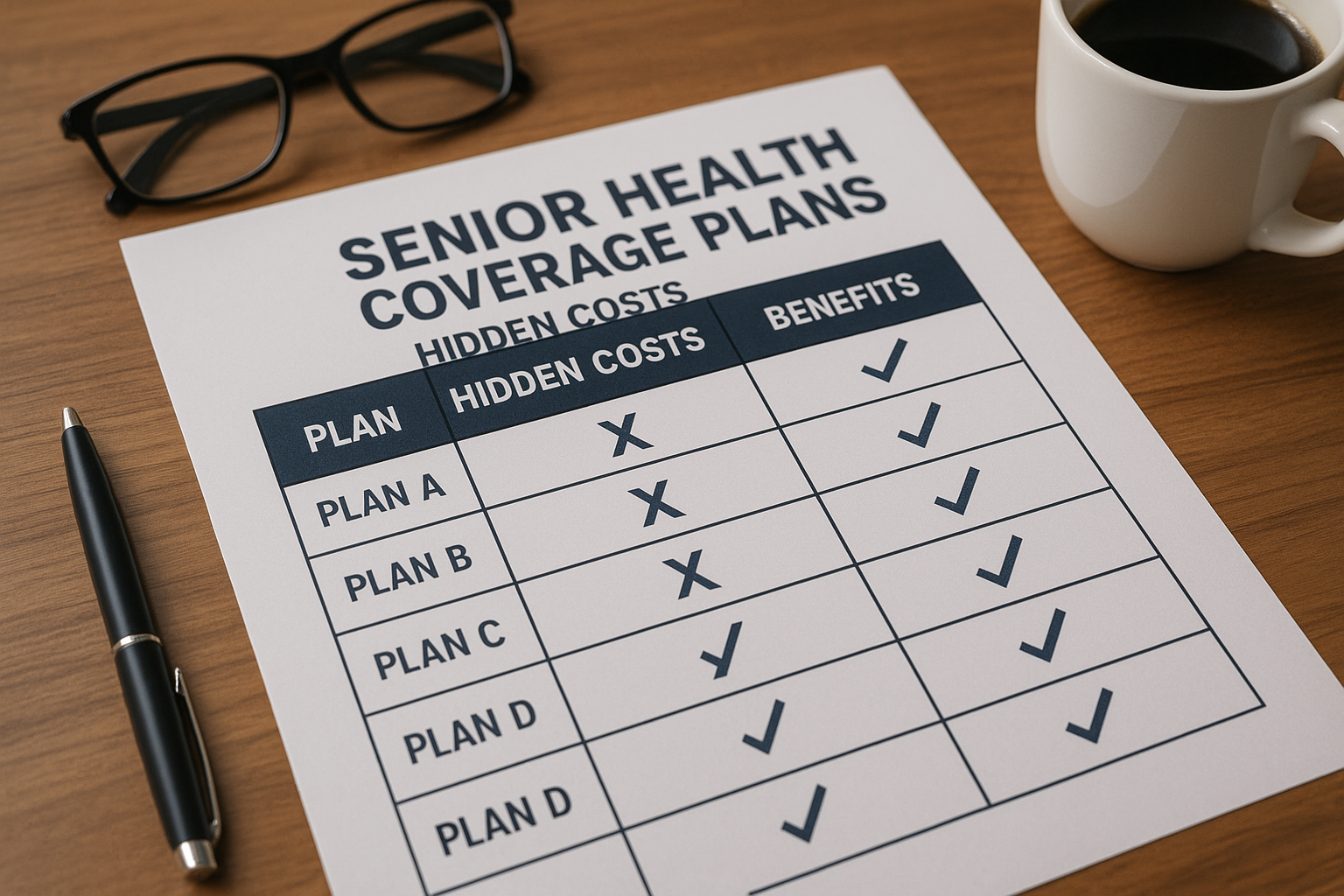

Senior health coverage is a complex landscape, often shrouded in confusion and fine print. At its core, it encompasses Medicare, Medicare Advantage plans, and supplemental insurance options. Each of these has its nuances and benefits, which can significantly affect your healthcare costs and coverage.

Medicare, the federal health insurance program for people aged 65 and older, is divided into several parts: Part A covers hospital insurance, Part B covers medical insurance, Part C (Medicare Advantage) offers an alternative way to receive your Medicare benefits, and Part D covers prescription drugs. Many seniors are unaware of the additional benefits that Medicare Advantage plans can offer, such as dental, vision, and hearing coverage, which are not typically covered under traditional Medicare1.